Complete Integration with Purchaser

Depending upon how thorough your Pre-Closing Integration Planning was in Step 13, you may have little left to do. Some integrations can be relatively simple, especially if the deal structure is a simple asset purchase. Other, more complex transactions can be greatly facilitated by engaging an experienced “Transition Team.”*4

Integration Best Practices

| SALES/MARKETING | • Vision/Strategy • Marketplace Positioning • Sales Strategy |

| HUMAN CAPITAL | • Culture • HR Concepts, Benefits, Compensation Plans • Organization • People |

| RELATIONSHIP MANAGEMENT | • Customers • Dealers/Partners • Suppliers |

| OPERATIONS | • Processes • Systems/Procedures • Product/Technology |

| FINANCE | • Customer and Vendor Billing, Cash Management • Visibility and Reporting • Budgeting & Forecasting • Consolidated Cash Management |

The Integration Plan

- Both sides should define a multi-disciplined task force that works together as one team[15]

- Hire a full-time executive officer as dedicated integration manager to guide the process

- Have the integration team develop the plan and execute it

- Have regular reporting

GOAL: ESTABLISH OPERATING MODEL, MITIGATE RISK, SATISFY STAKEHOLDERS

The Integration Plan: Establish Operating Model

- Organizational Chart

- Roles and Responsibilities

- Compensation and Benefits

The Integration Plan: Mitigate Risks

- Retain key employees

- Protect Intellectual Property and other confidential information

- Engineer short-term wins, within the first 100 days after closing

The Integration Plan: Satisfy Stakeholders

- Shareholders

- Employees

- Customers

- Partners/Vendors

- Investment Banking Community

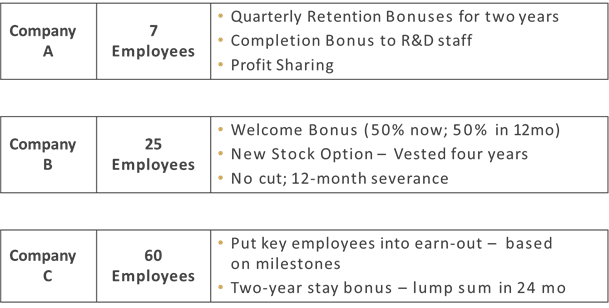

Sample Employee Retention Plans

PQ can provide a list of preferred third-party advisors for Step 15 including Transition Specialists, Wealth Managers, Executive Recruiters, Lawyers, Accountants and more.

Contact Us at any time for help or to provide feedback.