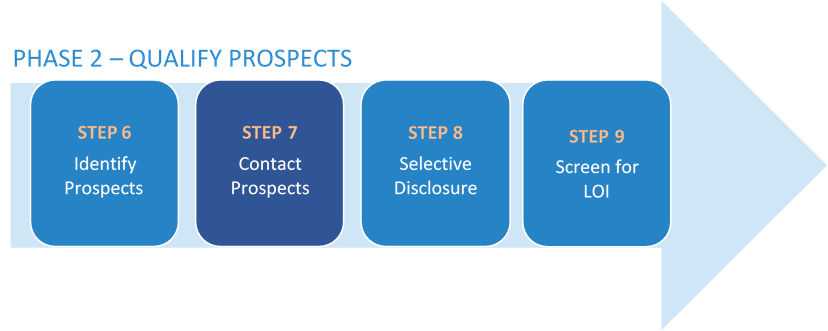

Contact Prospective Purchasers

Some sellers like to contact potential buyers anonymously to test the waters. In these cases, you:

- Will ensure your teaser (Step 5) is cleansed of any identifiable information or references to your company

- Enlist the aid of a third party to transmit your solicitation letter and teaser so there is no identifiable location. The third party could be an accountant, a lawyer, financial advisor, or even PQ.

- Ensure that you have a confirming response of interest and a signed Non-Disclosure Agreement (NDA) transmitted and received by your third party prior to revealing the name of your company. These steps will prevent the recipient from disclosing that your company might be for sale and prevent them from “shopping” your company to another possible buyer (especially if the recipient is a financial purchaser such as a Family Office or Private Equity firm).

Sometimes it will be difficult, if not impossible, to remain anonymous. In most Middle Market sales, you will already know the potential buyers that will be most interested in purchasing your company. These strategic buyers (competitors, suppliers and distributors) will often easily recognize your company – an anonymous teaser will probably be of little use. Therefore, you:

- May choose to contact the potential buyer directly (and not use an intermediary third party)

- Disclose that, at some point, under the right circumstances, you may be ready to sell your company

- Will then ask if the potential buyer has an

interest in considering a purchase. If the answer is affirmative:

- Send an NDA for execution. After receiving the executed NDA:

- Inform the potential buyer that you are ready to start the process of exploring a potential sale and ensuring a good fit

Staging Potential Buyer Contact to Create an Auction Environment

Introductory Letter

- Anonymized “teaser” sent to potential buyers

- Positions your company for sale – different than positioning a product or raising money

- Describes the current and future opportunity

Contact Documents

- Company Background

- Market Opportunity

- Products/Technology

- Sales Model/Distribution

- Future Products/Markets

- Competitive Landscape

- Strategic Considerations

- Summary Financials

- Staffing/Management

Be concise, persuasive, no proprietary information!

Valuation Presentation

Whether you have created an independent valuation of your company, or used one or more of the modules in Step 4 of PQ you should have available some form of valuation presentation for prospective purchasers; e.g.,

- Market-based “comparable companies”

- Equity value

- Asset sale value

- Book / Enterprise value

- Discounted Cash Flow

- Multiple of Earnings

- Or a combination of the above

Non-Financial Strengths

Additionally, non-financial information emphasizing strengths can be included

- Organizational chart

- Bios of key personnel

- Customer or project profiles

- Sales pipeline analysis

- Technology overview (patents)

- Map the company to best practices & trends

At this stage, especially with a strategic buyer (and even more so with a direct competitor), you might consider asking for

- A “disclosure fee” because you will henceforth be revealing competitive information that will have market value to the recipient whether or not they consummate a deal to buy your company

- An “escrow deposit” to be released to you if and when a decision not to proceed with a purchase. Again, this is a justifiable request because the recipient of your company information during due diligence will have market value – and perhaps diminish your competitive position

The amount paid for a disclosure fee or put in escrow will be a function of what you feel is the potential effect on your company’s value as a result of the disclosures you are about to make.

Either at this point or at the beginning of Step 8 you will need to enter into a Non-Disclosure Agreement (NDA). There are many boilerplate versions of these online (Google “Boilerplate NDA” to see many offerings). However, this is probably a good place to consider engaging legal support to ensure that you are protected through the entire sales process. You can visit the PQ Community to contact lawyers if you do not already have an experienced business contracts attorney.

The pitfalls of not getting adequate protection are many:

COURT AWARDS $126M IN DAMAGES FOR BREACH OF LLC AGREEMENT

PQ can provide a list of preferred third-party advisors for Step 7 including Lawyers, Management Consultants, Accountants and more.

Contact Us at any time for help or to provide feedback.