Negotiate Term Sheet or Letter of Intent

Negotiation is a process that begins with the very first contact with a potential buyer. Forthright personal interaction with all potential buyers is important to maintain mutual personal respect, save everyone’s time and get to the heart of whether a deal is possible and mutually beneficial.

When necessary, you should be prepared to use other members of your team or outside intermediaries (lawyers, accountants, or M&A professionals) to take the heat from contentious discussions.

This is the time when the objectives you set out in Step 1 come into play. You must establish your own priorities including understanding the type of deal structure you prefer. Here are some alternatives to think about:

Structure

- What is being purchased (stock or assets)?

- How much is being paid?

- How and when it is being paid?

- Are there other supporting items to consider, including contingencies?

10 Forms of Payment

- Cash

- Stock

- Debt assumption

- Employment

- Stock options

- Consulting

- Non-competes

- Earn-out

- Retention pool

- Profit sharing

How You Structure Your Sale Depends On

- Your revenue, industry, age and profitability

- Complexity of your ownership and debt situation

- Dynamics of your ownership (Are there conflicts among various owners? Are there outstanding options, etc.)

- How “Active” are some shareholders vs. other “Passive” shareholders

- Buyer’s capabilities, capacity

- Tax considerations of both organizations

There are many experts who believe that STRUCTURE IS MORE IMPORTANT THAN PRICE!

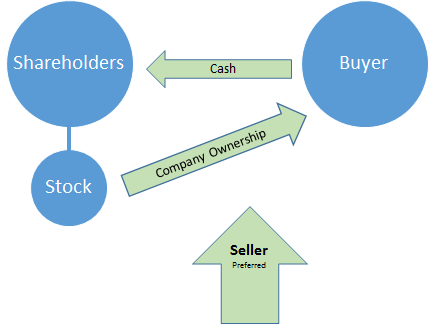

Stock vs. Sale of Assets

When Stock is Purchased:

- All of the outstanding shares of stock are transferred

- The buyer operates business uninterrupted

- Seller has no continuing company interest or obligations

- Often allows the seller to completely step away from the business

- Seller is usually entitled to pay taxes at the capital gains rate

- Assets and liabilities are sold

- May include tax loss carry forward

- Leases, loans, etc. may be transferred

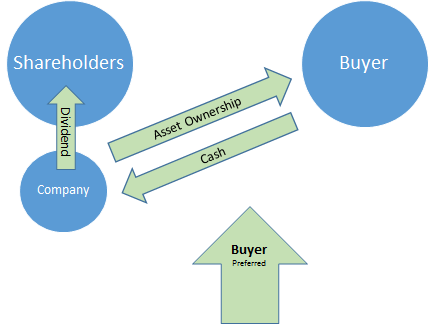

When Assets are Purchased

- No shares of stock are transferred

- Liabilities and taxes remain

- Company shell remains

- The seller retains ownership of the company

- The buyer must use another entity for the transaction

- Only specifically identified assets and liabilities are transferred

- Other assets and liabilities remain

- Eliminates need to negotiate purchase of share for minority/dissident shareholder

Assets Purchased Complexities

- Ownership of the assets and liabilities and any related contracts must actually be transferred

- Fair market value gains must be determined

- “Bulk Sales” rules may apply requiring notification of all of the creditors of a business

- Possible transfer of the corporate name

- Rehiring of employees by the buying entity

When Assets are Purchased

- The purchase price must be allocated among the different assets for tax treatment, buyer deduction:

- Tangible assets

- Customer lists

- Non-competes

- Consulting agreements

- Patents

- Royalty agreements

- Other intangibles

- Goodwill

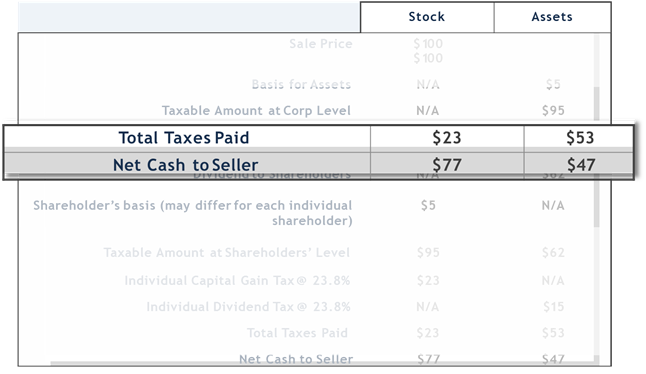

Tax Impact: Stock vs. Sale of Assets

The Structure you choose will have a major effect on how much you are capable of being paid for your company. In general, an “earn-out” will allow you to receive a higher overall price than receiving cash (which is least risky for a seller).

Earn-Out

- Can be revenue or profit based

- May take the form of royalties, commissions, OEM licenses, profit participation, etc.

- Is often capped and may have “break points” which stipulate payment schedules

- Can potentially be divisive and hinder integration because of conflicting goals

Earn-Out: A Potential Shareholder Dilemma

- There are potential legal problems with enforcement (e.g. If the entity is dissolved)

- Payout may be part of a key person’s employment agreement

- Potential problems between “active” & “passive” investors

- May involve performance stock options

- Those staying with the company receive more than those who leave – or are no longer needed

Transactions that take place between a Seller and Buyer from different countries create Cross-Border Issues

- Unique aspects of cross-border transactions can cause delays in closing

- Stock Transferability (Listing problems)

- Regulatory Approvals (Slow government review)

- Foreign Exchange Limitations (Currency control)

- Reduction in Force (RIF) (Local labor laws)

- Tax may be deferred if shares are exchanged for foreign securities

- You may need international counsel

- Foreign Ownership Limitations: Some countries limit ownership to less than 50% or require at least some local ownership

- Nesting/Tax Shelters: Many countries allow layers of ownership with capital gains exemptions and offshore holding company ownership

- Reporting Periods: May be very different and permit long reporting delays

- Quality of Reporting: Some countries are less strict on their reporting so the quality of data may be poor or misleading and not readily available

Closing Thoughts on Deal Structure

- Structure is more important than price

- Deal structures vary, based on revenue, industry, age or maturity of the company, profitability, etc.

- Flexibility on deal structure increases potential of a successful deal and perhaps the price

- Several forms of payment (stock, cash, earnout) are likely to be used in a transaction

- Each payment form has advantages and disadvantages and should be evaluated in the context of your personal goals

In most cases as you negotiate the Deal Structure, you will have the most leverage early in the process of negotiating the Term Sheet. Make sure the potential buyer understands your basic deal parameters and try to understand the buyer’s wants and needs.

What Elements of the Deal are You Negotiating?

| Buyer | Price Structure Liabilities Taxes Employment Non Competes | Seller |

Price

- You want the buyer to pay at least Intrinsic Value

- The Buyer would prefer to pay less

- You want the buyer to assume most, if not all, of the risk

Risk

- Assuming you have a strategic buyer, you want him to share the delta between Fair Market Value and his Strategic Value; the buyer would prefer to keep it all

- He would prefer that you take all the risk for an unlimited time.

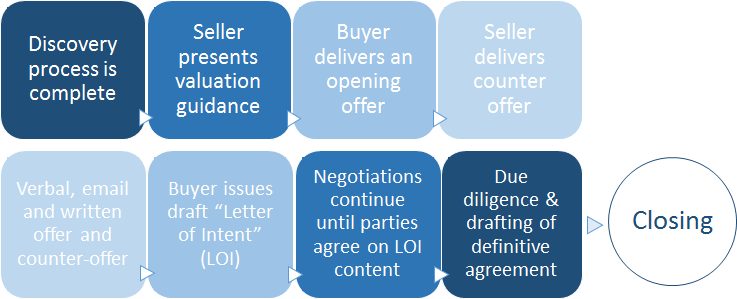

Typical Negotiation Flow

Negotiation: The Basics

- Negotiation is not an event, but a process that begins with the very first contact

- Early and personal interaction is important

- Use your intermediaries to take the heat from contentious discussions

- Determine your own position before beginning

- You have the most leverage early in the process

- Make sure the potential buyer understands your deal parameters before you solicit an LOI

- Try to understand the buyer’s wants and needs

- Express appreciation for buyer efforts

- Don’t offer a positive view of the buyer’s position in a way that implies your acceptance of it

- Avoid buyer serial negotiation – agree on items, document them and move on to other issues

- Build a negotiating framework leading to common ground

- Deal honestly and openly – don’t get emotional

- Be flexible and open-minded

- If you encounter a “screamer,” have at least one additional person from their team present at negotiations

- Include “straw men” to let the other side win; do not expect to win every point

When You Have to Dig in Your Heels:

- At least agree with the buyer on what the outstanding issues are, before taking a break from the negotiating table

- Do not walk away before reinforcing all of the reasons why the deal should proceed

- Do not walk away without giving the buyer a clear path back to the negotiating table

Typical Buyer Tactics include

- Hiding the true level of interest they actually have

- Attempting to receive all the benefits of an acquisition

- Disputing the quality of the valuation, e.g. “Your price is unreasonable – sharpen your pencil”

Typical Seller Tactics include

- Creating competition – trying to move toward an auction process

- Revealing problems early while leverage is highest

- Being specific in the LOI (Letter of Intent)

- Avoiding or limiting a “no-shop” condition

- Tying exclusivity to buyer achieving milestones

- Negotiating a creative structure to close the valuation gap between buyer and seller

- Closing as quickly as possible

Key ingredients to Seller Conduct during the Negotiating Process

- Understand your market value

- Be transparent and responsive

- Run a fair and efficient “auction” among prospective Buyers

- Don’t be greedy

IF A BUYER SENSES YOU ARE PLAYING GAMES, THEY ARE LIKELY TO MOVE ON

Judicious Use Of “Outsiders” *

There are going to be times and situations when you will be well-served by having expert outside assistance. Here are a few examples:

M&A Lawyers’ Responsibilities

- Corporate law – governance, rights & duties of board and shareholders

- Contract law

- Intellectual property – trade secrets, copyright, trademark, and patents

- Tax law

- Securities laws (public and private company stock)

- Employment, pension, employee benefits, and ERISA

Note: AN INEXPERIENCED ATTORNEY CAN KILL THE DEAL*

The Role of Your Accountant

- Review your business’s financial records to ensure GAAP compliance and assist in recasting financials

- Assemble new or adjusted financial statements

- Answer questions from buyer’s due diligence team

- Address tax issues raised by either party

- May supply staff to help with PQ

Advantages of an M&A Intermediary, Consultant, Wealth Manager or Banker

- Provides a link to a broad base of qualified, potential acquirers (auction process)

- Help you best prepare and position

- Value the business and validate a fair price

- Obtain a substantially better financial package

- Have contract examples from other deals

- Allow you to focus on running your business

LOI-to-Closing Process

PQ provides template LOI’s for reuse in your sales effort (must be reviewed and approved by your attorney).

Letter of Intent (LOI) Terms

- Agreed purchase price – structure

- The parameters and procedures to proceed toward a definitive agreement

- Confidentiality

- Rules for accessing due diligence materials

- No shop – seller’s biggest control item

- Standstill provisions

- Conduct of business; Hire/fire; balance sheet, etc.

- Breakup fees

- Contingency price adjustments

- Jurisdiction

Conditions for completing the deal

- Successful completion of due diligence

- Execution of the definitive agreement

- Perhaps other milestones

- Closing date

Example of LOI Evolution

PQ can provide a list of preferred third-party advisors for Step 10 including Merger & Acquisition Specialists, Wealth Managers, Tax Consultants, Lawyers, Accountants and more.

Contact Us at any time for help or to provide feedback.