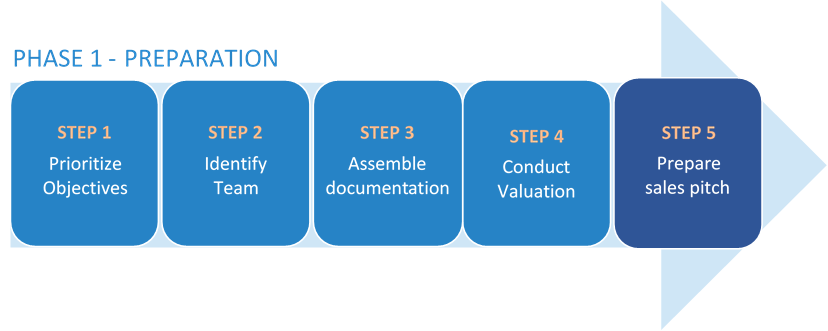

Prepare Your Sales Pitch

Your sales pitch starts with a teaser, giving an attractive introduction to prospective buyers. Following the teaser, in anticipation of boardroom presentations to buyers who have been qualified and to whom you wish to disclose greater detail, as well as planning for the due-diligence process, additional and more detailed business plan collateral will be required.

Executive Summary, or “Teaser”

PQ includes sample and template teasers and business plan collateral that will help you compile a “pitch book” to support the full sales process.

The teaser should impart only the basics. Keep it brief, preferably 1 page! The teaser should include the following:

- When your company was founded

- How your company generates revenue

- Sales and revenue mix of products and/or services

- The industry categories you sell into

- Key distribution channels used by your company

- KPI’s relative to peers

- Summary bios for top management and board members

- Overall financial profile: at least 3 years – preferably 5 years – of historical Revenue and EBIT/EBITDA and at least two years of projected revenue and EBIT/EBITDA

- Summary of core assets

Some industries or situations may require slightly more financial information, such as gross profit or EBIT or other specific statistics (number of customers, units sold, etc.).

Key Highlights

Because this is your “Sales Pitch” you should emphasize highlights. These selling points are the strengths and unique attributes of your business. Here are some examples:

- Proprietary relationships with vendors: If your company is the only company (or one of a limited few) that can buy from a certain vendor, that’s a selling point you can trumpet in the teaser.

- Nature of customer relationships: For some buyers, acquiring companies with Fortune 500 relationships is a main consideration. For others, selling to consumers or middle market companies is the key aspect.

- Average sale size: Some buyers want to acquire companies that make large sales. The larger the average sale size, the faster/more easily the company can grow.

- Recurring revenue: Similar to average sale size, the holy grail of recurring revenue (revenue that occurs over and over again after making the initial sale; think of your cellphone bill) helps a company grow. A company doesn’t need to have 100 percent recurring revenue, but any amount of recurring revenue is worth mentioning in the teaser.

- Revenue growth: A company with growing top-line revenue usually has growing bottom-line profits.

- Profitability: The only thing better than a highly profitable company is a highly profitable company that’s growing.

- Proprietary property: If the company has proprietary software or processes — something that the competitors don’t have — that becomes a potential selling point. Examples include intellectual property, domain expertise, technology, exclusive sales channels, alliances, key legal agreements, etc.

The items in the lists above are just examples. The teaser should highlight whatever makes the company special, different and desirable. See PQ samples and templates to get started.

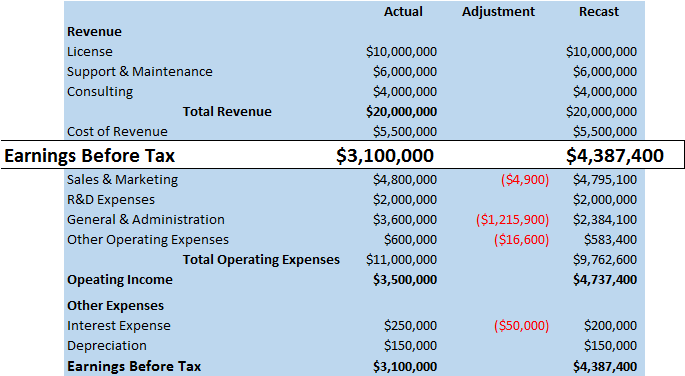

Recasting Financial Statements

At this time, you may also consider recasting your financial statements to enhance key operational measures and your appeal to prospective buyers. Options include making adjustments to identify or exclude idiosyncratic, one-time or unusual elements that would not exist post-sale to the prospective buyer. By so doing, you most likely increase the attractiveness of your income statements and balance sheets to your prospective buyers.

Recasting Income Statement

Adjustments to restate profitability and cash flow often address:

- When taxes were minimized

- The owner received extra benefits

- Unusual/one-time income or expenses

- Typical adjustments include:

- Auto/Travel

- Non-recurring expenses

- Donations/personal projects

Recasting Balance Sheet

Depending on your circumstances, it may be wise to consider recasting your Balance Sheet. If you do,

- An effort should be made to obtain the fair market value of all assets

- Typical adjustments include:

- Excess cash

- Consolidating / refinancing debts for cash-flow improvement

- Debt to owners

- Retirement benefits

- Unrecorded bonus

- Accrued vacation, etc.

Example: Recast Before & After

PQ can refer you to third-party advisors for Step 5 including Management Consultants, Tax Consultants, Lawyers, Accountants and more.

Contact Us at any time for help or to provide feedback.