Conduct a Company Valuation

PQ provides multiple ways for you to get market-based valuations of your company. Among your choices are:

- Comparison with Similar Companies – using a patented process based on data from over 30 million companies

- Equity Valuation – a calculation of the value of the company available to its owners or shareholders and incorporates all of the assets included in the asset value plus the firm’s liquid financial assets (cash, A/R, deposits, etc.) and minus its liabilities ST & LT.

- Asset Sale Valuation – a calculation of the firm’s inventory, furniture, fixtures and equipment and all intangible assets ranging from customer base to goodwill.

- Book or Enterprise Valuation – equal to the “total value of the firm” or the value of the firm’s equity plus its long-term debt, e.g. it reflects the value of the entire capital structure (equity holders and debtholders) or “enterprise”.

- Liquidation Valuation – based on the key assumption of insolvency and the immediate sale of all assets (on or off the balance sheet) at or near “fire sale” level, coupled with the nearly simultaneous retirement of all liabilities. This figure does not include accounts receivable.

- Discounted Cash Flow (DCF) Valuation – a very common mathematical calculator used by financial analysts

- Earnings Multiples Valuation – based on an industry-based standard metric applied to the earnings of similar publicly traded companies

Other valuation techniques will be added over time

In addition, PQ helps you:

- Identify and evaluate core business assets that contribute to overall business value, which also can be leveraged for buyer financing assistance

- Identify alternative deal structures that augment the valuations

These methodologies are by no means exhaustive of the possible ways to value your company. Nevertheless, they are all widely accepted as valid techniques and will provide a good “argument” on your behalf for what your company is worth. Please feel free to use as many methods as you like.

We also have as members of our PQ Community, both Certified Public Accountants (CPAs) and Certified Valuation Analysts (CVAs), the most widely recognized business valuation credential.

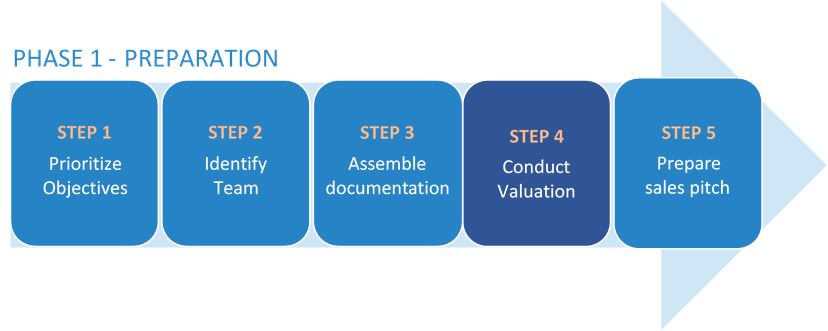

When choosing one or more of the PQ valuation modules, you will find easy-to-use guides to take you step by step through the process. At the completion of the valuation you will receive a descriptive report that can be retained, incorporated into your sales collateral, or forwarded to prospective purchasers. Step 4 creates an important part of the basis for your establishment of a value for your company.

The valuation process is often iterative rather than a one-time step. You can set an initial baseline using any or all of the available tools, then evaluate your other assets, intangibles, and business elements that can be restated or adjusted (e.g., debt refinancing to improve cash-flow, or referencing the industry KPI’s that are provided to identify where improvement or restatement opportunities) to maximize the valuation, and revisit the valuation tools iteratively as those adjustments are made.

Last, in addition to the mathematical and market-based measures, every company has certain intangibles that you should take into account before suggesting to a potential buyer that your company has a specific value. Some of these intangibles include:

- Business Alliances

- Customer Base

- Intellectual Property

- Sales Channels

- Domain Expertise

- Business Alliances

- Customer Base

- Intellectual Property

- Sales Channels

- Domain Expertise

These intangibles can result in raising (or lowering) your asking price.

PQ can refer you to third-party advisors for Step 4 including CPAs, CVAs, Tax Consultants, Lawyers, Accountants and more.

Contact Us at any time for help or to provide feedback.