Identify Team Skills Needed for the Deal

Most owners of Middle Market businesses are too busy running their business to personally devote the time required to manage a sale of their company. Usually a senior executive (e.g., the CFO, COO, CMO) is tasked with leading & coordinating the activities in conjunction with a team that is overseen by the owner or CEO.

You might consider creating a grid outlining the various players on your team and their respective assignments as pictured in the illustration below (SellPQ provides a template worksheet and guided interview to complete this step):

You will want to conduct a similar exercise once you enter into discussions with prospective buyers, to clearly identify and understand the role and responsibilities of the buyer’s team.

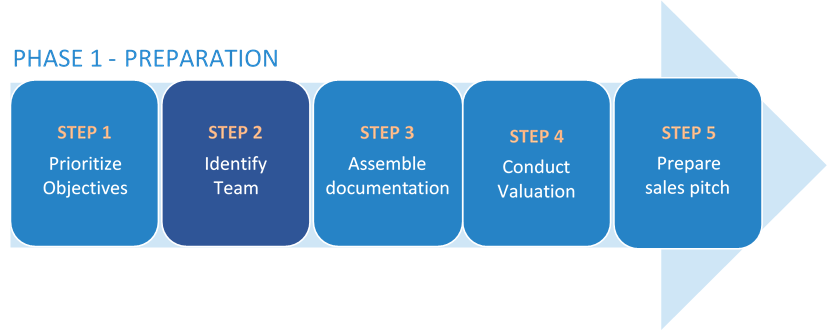

The steps involved include:

- Prioritizing the overall objective(s) delineated in Step 1

- Setting tasks and a targeted timeline for the sale

- Allocating company staff to specific tasks to ensure all needs will be addressed. Remember, nearly 80% of Middle Market companies complete a sale transaction without using outsiders – so it can be done.

- Determining at which stages “outside” assistance will be engaged, e.g.:

- Accountants to provide audited statements, financial projections or tax returns

- Tax advisors to determine outcomes with alternative deal structures

- Wealth managers to provide advice on what owners should do with company sale proceeds to meet their personal financial objectives

- Management consultants to improve company profitability or reduce costs prior to contacting buyers

- Bankers to help structure your deal or provide debt financing for buyers

- M&A firms for assistance identifying buyers beyond those “strategic buyers” such as your competitors, suppliers, distributors, etc. Usually a strategic buyer will pay a higher price for your company than a pure “financial buyer” such as a family office or private equity firm

- Valuation services even though SellPQ offers multiple methodologies for getting a market-based value for your company, under special circumstances you may decide you want a certified valuation (e.g., IRS section 409A valuations) before you make contact with potential buyers

- Conducting internal due diligence to make sure all needed financial, managerial, operational, competitive, legal, intellectual property and other substantive material of interest to a potential buyer is available.

PQ can refer you to third-party advisors for Step 2 including Buyer Prospecting Tools, Wealth Managers, Tax Consultants, Lawyers, Accountants and more.

Contact Us at any time for help or to provide feedback.