Prioritize Your Objectives for the Sale

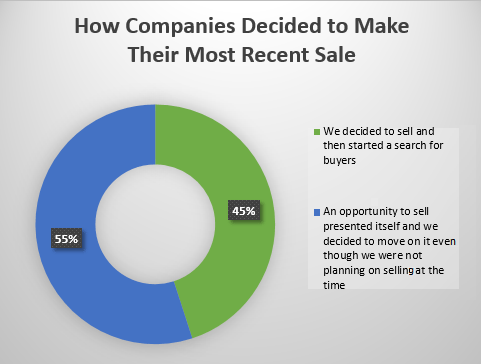

Selling your company may be something you have been planning for a long time. However, according to the National Center for The Middle markets, almost half of all company sellers do so because an unsolicited and/or unexpected opportunity arises, and many sellers look back upon their selling experience with the feeling that they could have managed the process better, and to better outcomes, with better preparation.

Be ready for a sale – at any time – by being prepared. Periodically, and certainly before deciding to start a sales process, discuss at board meetings or among your fellow shareholders the objectives you are seeking through a possible sale of the company.

There may be multiple objectives (e.g. maximizing the cash proceeds, retaining a 10% equity interest going forward, while maintaining the jobs of family members and long-time employees) or sometimes there is only one overriding objective such as minimizing personal risks, avoiding/reducing taxes, achieving top price for your assets, ensuring non-compete agreements, etc.

Typical objectives include:

- Maximizing Liquidity – because the company requires a cash injection for operating or growth purposes – or the owners want to “cash out” and reinvest in other assets

- Conflict Resolution – there may be a dispute among the owners, with family members, the board of directors or employees that cannot be resolved with the current ownership structure

- Personal Issues – the owner may have died or have serious health problems, suffered “burnout,” is going through a divorce, etc.

- Structural Challenges – there is a technological threat or opportunity, a competitive threat, a dynamic change in the market characteristics

The objectives you set – and the reasons behind them – will affect many of the subsequent steps you take in the sales process; e.g.:

- which potential purchasers you approach

- how much information you reveal at each stage of the negotiations

- what kind of deal structure you propose

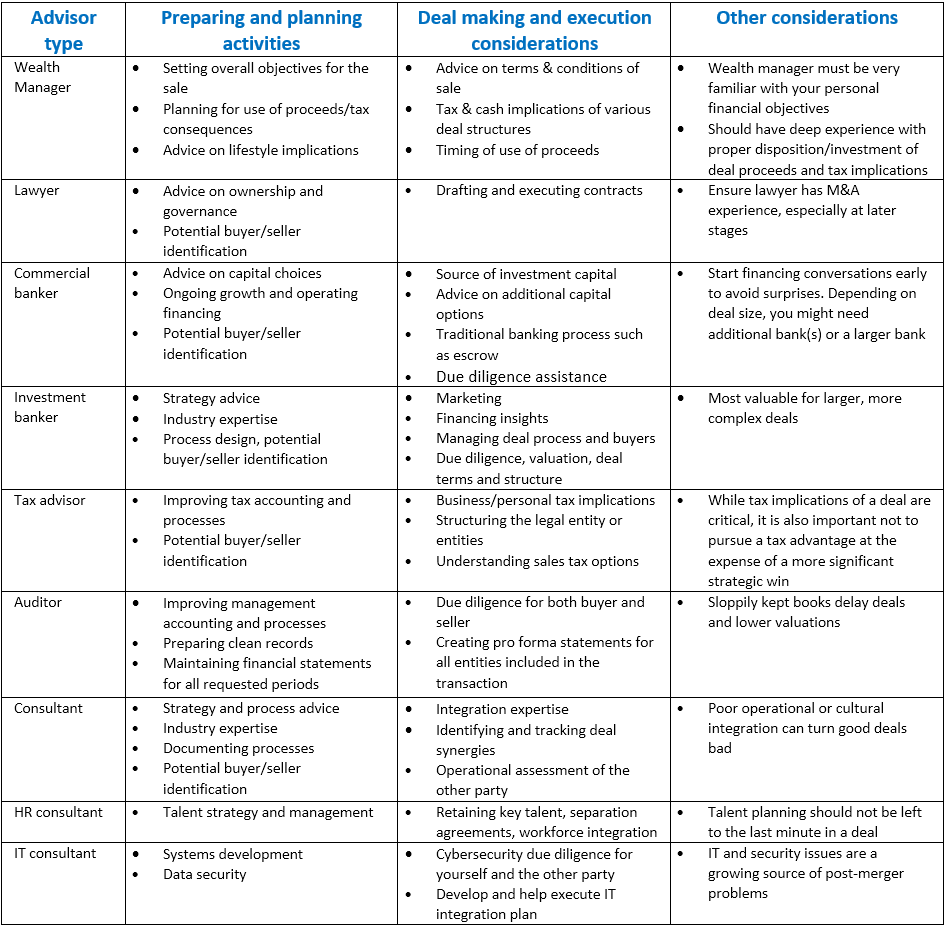

- what types of 3rd party assistance you seek (tax advisors, bankers, wealth managers, etc.)

There are many experts who believe that structure is more important than price! Consider how your own priorities will influence the type of deal structure you prefer. Here are some alternatives to think about:

- What is being purchased (stock or assets)?

- How much is being paid?

- How and when it is being paid?

- Are there other supporting items to consider, including contingencies?

How you structure your sale depends on:

- Your revenue, industry, age and profitability

- Complexity of your ownership and debt situation

- Dynamics of your ownership (Are there conflicts among various owners? Are there outstanding options, etc.)

- How “Active” are some shareholders vs. other “Passive” shareholders

- Buyer’s capabilities, capacity

- Tax considerations of both organizations

See Phase 3, Step 10: Negotiate Term Sheet for more detail.

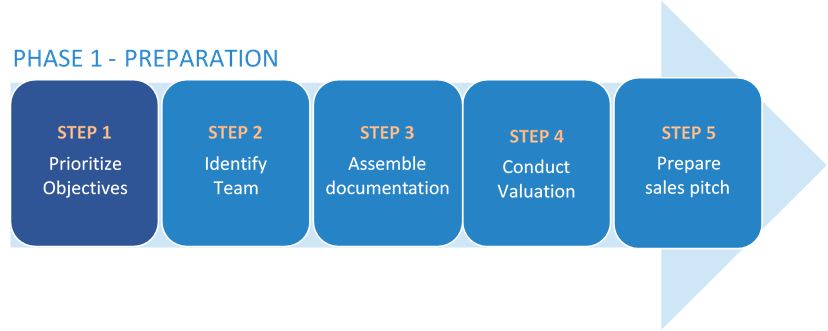

Here are some examples of where and when you may need support from outside professionals during the sales process:

PQ can refer you to third-party advisors for Step 1 including Wealth Managers, Tax Consultants, Lawyers, Accountants and more.

Contact Us at any time for help or to provide feedback.